If

you’re building a FinTech start-up in the United States, licensing feels like a

slow leak draining momentum. We’ve watched founders design

brilliant payment products—only to lose a year dealing with paperwork. What

looks like one application quickly turns into fifty unique ones, each with its

own fees, bonds, and deadlines. The truth is clear: in American finance,

compliance is not optional, and it is never inexpensive.

Every

FinTech offering payments, remittances, or wallet services must hold a Money

Transmitter License (MTL) in each state of operation. There is no single

federal fast track. Each state regulator sets its own interpretation of “money

transmission,” its own surety bond requirements, and its own renewal process.

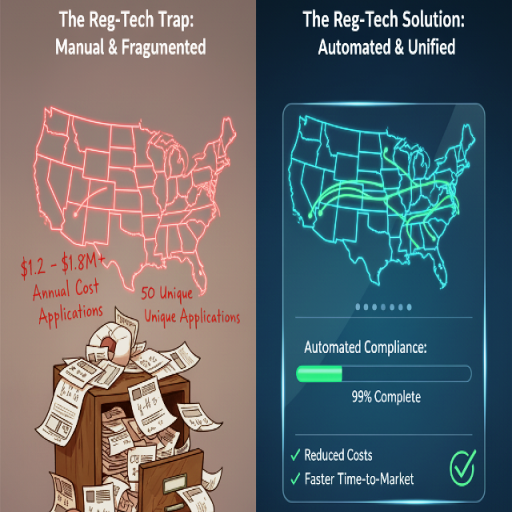

As

of the 2026 outlook, a full multi-state deployment typically costs US $1.2 –

1.8 million and takes around 15–24 months. The real cost extends far past the

official regulator fees, driven mainly by ongoing operational expense.

Application

fees: US $250 – 10 000+ per state

Surety

bonds: US $50 000 – 1 000 000, connected to transaction volume

Annual

renewals: US $250 – 1 500

Operational

overhead: Compliance staffing (e.g., $100k+ annual salary for a dedicated

compliance officer), audit fees, and specialized AML/KYC technology

subscriptions

Even

a 10-state launch can require US $200 000 – 350 000 before a single transaction

is processed, with much of that money tied up in bonds and legal fees that do

not generate revenue.

The

table below presents an updated picture of licensing burdens in important

jurisdictions. Remember that capital (net worth) requirements, which vary by

state, must also be maintained and represent a major hidden expense.

|

State |

Application Fee |

Surety Bond Range |

Net Worth Requirement |

Typical Approval Time |

|

California |

US

$5 000 |

US

$250 000 – 1 000 000 |

Varies,

minimum $250,000 |

9

– 18 months |

|

New

York |

US

$3 000 |

US

$500 000 – 1 000 000 |

Varies,

minimum $500,000 |

12

– 24 months |

|

Texas |

US

$1 500 |

US

$300 000 – 500 000 |

Varies |

6

– 12 months |

|

Florida |

US

$1 000 |

US

$100 000 – 500 000 |

Varies |

4

– 9 months |

|

Illinois |

US

$1 200 |

US

$250 000 – 750 000 |

Varies |

6

– 10 months |

Sources:

Updated industry estimates, NMLS, and state regulator filings (2026 outlook)

Consider

a start-up from Austin expanding to twenty states. Between license

applications, surety bonds, and compliance submissions, its first-year cost

tops US $500 000. The product is complete, but funding is stalled. Investors

ask about launch dates; regulators request more documents. Growth stops while

paperwork continues—a textbook case of the Reg-Tech Trap.

Financial

rules in the U.S. remain state-based. Forty-nine states plus Washington D.C.

regulate money transmission—Montana remains the single exception. The

disjointed structure is starting to move toward a more coordinated approach,

mainly because of the Conference of State Bank Supervisors (CSBS).

The

CSBS created the Money Transmission Modernization Act (MTMA) to coordinate key

requirements across the nation. As of mid-2025, over 40 states have enacted the

MTMA fully or in part. Importantly, money transmitters licensed in

MTMA-adopting states collectively perform 99% of all reported money

transmission activity. This coordination, which affects requirements for net

worth, surety bonds, and approved investments, is simplifying operating

complexity.

This

movement explains why many founders still begin in high-value states

first—California, New York, or Texas—but can now plan national expansion with

improved consistency.

(Learn

more in our PenMatrix feature on Open Banking API Rules in the U.S.)

The

noticeable application fees are just one part of the cost. Maintaining licenses

is the dominant expense, often two or three times the statutory costs. This

operational expense includes:

Dedicated

Staffing: Required compliance officers whose salaries often exceed US $100 000

annually.

Technology

& Systems: Annual costs for transaction monitoring, sanctions screening,

and AML platforms, which can cost $20 000–50 000 based on volume.

Audit

Overheads: Required annual financial statement reviews and independent AML

audits, frequently costing $15 000–30 000+.

FinTechs

must commit 10–15 % of operating expenses purely to license maintenance and

oversight. Missing a single renewal notice can lead to suspension or penalties

under 18 U.S.C. § 1960, which makes unlicensed money transmission a crime.

To

handle this cost spiral, FinTechs increasingly use Regulatory Technology

(RegTech) platforms that automate the manual work of monitoring and reporting.

RegTech offers a centralized solution to the fragmented reality of state laws.

Automatic

tracking of changing state rules, including updates from the MTMA.

Centralized

KYC/AML workflows and audit logs, prepared for regulator review.

Real-time

dashboards for managing license renewals and surety bond updates.

Automated

transaction reporting to multiple regulatory bodies (NMLS).

The

global RegTech market was valued at US $12.47 billion in 2023 and is projected

to reach over US $72 billion by 2032, reflecting a Compound Annual Growth Rate

(CAGR) of over 21.6 %. This rapid climb shows how essential automation has

become. The most successful FinTechs in 2026 combine technology accuracy with

regulatory skill, understanding that tools still require human oversight for

rule interpretation and regulator interactions.

Prioritize

MTMA-Adopting States. Begin licensing in the 40+ states that have adopted the

MTMA first. This ensures a more coordinated and predictable initial expansion.

Estimate

total operational expense. Include bonds, yearly renewals, IT systems, and

dedicated compliance staffing from the start.

Build

regulator relationships early. Make use of the MTMA's standardized rules to

simplify initial communication and reduce approval time.

Consider

partnership methods. Some businesses operate under a licensed sponsor before

applying independently, effectively delaying the initial capital commitment.

View

adherence as brand capital. Investors and customers now judge maturity by how

responsibly you manage regulation.

(Related

reading: The Plaid Lie – Data Security in U.S. Open Banking)

The

time for unified licensing is coming. The widespread enactment of the Money

Transmission Modernization Act (MTMA) has been the most important event,

creating consistency in core financial requirements across the U.S. while still

preserving state-level consumer protection.

At

the same time, RegTech companies are expanding cloud-based compliance systems

now feature AI rule monitoring, OCR-based document verification, and warning

systems for renewal risks. Until the final states fully match their rules,

automation remains the quickest, most scalable way to cut complexity and reduce

the operational expense of multi-state compliance.

For

American FinTech founders, licensing is not unnecessary restriction—it’s the

price of credibility. Those who budget early for the full operational cost, use

RegTech wisely, and integrate compliance into their operations gain a

competitive advantage.

“Compliance

isn’t an obstacle to growth—it’s the foundation of trust.”

Plan

your licensing roadmap with the same precision as your product creation.

(Read

more insights in PenMatrix › Digital Banking & Technology)

1. What is a Money Transmitter License (MTL)?

A

state-issued permit allowing a business to transfer or store customer funds.

2. How long does nationwide licensing take in 2026?

Usually

15–24 months, depending on document quality, regulator backlog, and which

states are prioritized.

3. Average per-state cost in 2026?

Between

US $250 and 10 000, plus surety bonds up to US $1 million, and substantial

operational costs.

4. How many states have adopted the MTMA?

Over

40 states have adopted the Money Transmission Modernization Act (MTMA) in full

or in part as of mid-2025.

5. Do crypto firms need separate licenses?

Yes.

Many states treat virtual currency as money transmission, often requiring a

variation of the MTL.

6. Which state does not require a license?

Montana

is currently the only exception.

7. What happens if I operate without a license?

Violations

can trigger fines, cease-and-desist orders, and criminal prosecution under 18

U.S.C. § 1960.

8. How big is the global RegTech market?

The

market was valued at over US $12 billion in 2023 and is projected to reach over

US $72 billion by 2032.

9. Are surety bonds refundable?

The

bond itself is financial protection, not a fee. Unused premiums paid to the

surety company may be returned when licenses are surrendered, but the annual

fee is a sunk cost.

10. What’s the most efficient entry strategy?

Begin

with high-value states, use RegTech early to manage overhead, and scale

progressively leveraging the MTMA standards.

Comments (0)

Leave a Comment

No comments yet

Be the first to share your thoughts!