Imagine handing your house key to a stranger you

just met—all so they could deliver a package faster. Would you do it?

That key is your bank username and password. The stranger is a data aggregator like Plaid. And the package? The convenience of modern finance—Venmo transfers, budgeting apps, and instant credit approvals.

If you’ve used any financial app in the last five years, you have

already done this. You wanted efficiency, saw Plaid’s familiar login screen,

typed your credentials, and moved on.

But here’s the question few ask: Did you realize that until very

recently, this simple act meant exposing nearly everything in your bank

account—and that the law protecting you is now frozen?

Welcome to the hidden crossroads of US Open Banking. We were promised transparency and choice, yet the very system that powers convenience still carries deep security uncertainty. Let’s unpack what went wrong, what’s changing, and how you can safeguard your financial data today.

When

we talk about Plaid data privacy and security, the company emphasizes that it

doesn’t sell user data. That’s true. The real risk came from the original

connection method itself.

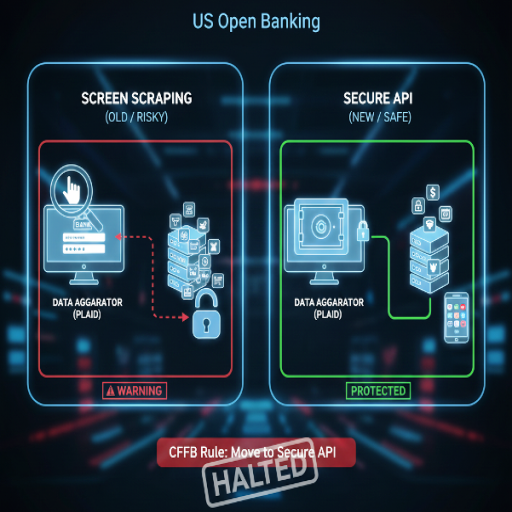

Screen scraping allowed an

aggregator to log in to your bank using your actual username and password, then

copy the visible data. It was the digital equivalent of giving a stranger your

master key so they could photograph your filing cabinet.

This

exposed two major issues:

1. Credential Exposure — Even

if Plaid replaced your credentials with a secure token, the initial handoff

bypassed your bank’s protective layers.

2. Data Over-Collection — Because the entire online banking view was scraped, aggregators often collected far more data than needed.

In

2022, this practice led to a $58 million class-action settlement against Plaid

for alleged lack of transparency. The company responded with new disclosure

tools and invested heavily in replacing scraping with secure APIs—direct,

permission-based data pipelines issued by banks themselves.

By

early 2024, Plaid reported that 75 percent of its data traffic had already transitioned

to or committed to API-based connections. This is the model the future depends

on—but legal uncertainty now threatens to delay that transition.

Recognizing the dangers of uncontrolled data sharing, the Consumer Financial Protection Bureau (CFPB) finalized the Personal Financial Data Rights Rule (under Section 1033 of the Dodd-Frank Act) in October 2024.

It aimed to ban fees for data access, enforce clear consent, and phase out

screen scraping altogether.

However,

in October 2025, a U.S. District Court issued a stay, freezing enforcement

after banking associations filed lawsuits challenging the rule. The CFPB then

announced a full reconsideration process.

Here’s

what that means for you right now:

No-Fee Guarantee at Risk: The

agency is reconsidering whether banks can charge for data access. If allowed,

even viewing your own financial data through an app might come with a cost.

Restricted Third-Party Access: Regulators

are debating whether only fiduciary entities may handle consumer data, which

could reduce the range of financial tools available.

Missing Liability Framework: It remains unclear who is responsible when unauthorized transactions or data breaches occur—banks, apps, or aggregators.

This

pause means the long-awaited security reforms under US Open Banking consumer

protection rules are delayed, extending the lifespan of riskier data-sharing

systems.

For a

deeper look at the legal structure, read The

CFPB’s Section 1033 Rule: How the New Regulation Will Redefine Data Ownership.

The

October 2025 freeze makes one reality clear—your data protection starts with

you. Until the new rule resumes, these actions will keep your information safer:

1. Audit Your

Connections via the Plaid Portal: Visit my.plaid.com to review all

connected apps. Remove any that you no longer use. Every revocation limits

exposure.

2. Favor Secure API

Connections: When

adding new services, check if they use your bank’s branded login (OAuth or

“Sign in with [Bank Name]”). That means your credentials stay with the bank—not

the aggregator.

3. Enable Multi-Factor

Authentication (MFA): Always

require a second verification method for any account that links to your

financial data.

4. Demand Transparency: Before

granting access, read the app’s privacy policy. Look for clear limits on data

use, sharing, and deletion.

5. Support a Strong

Liability Framework: Add

your voice during CFPB public-comment periods. Advocate for rules that make

institutions accountable for security lapses.

Explore

the technical transformation in From

Screen Scraping to Secure APIs: The Evolution of FinTech Data Sharing and Why

It Matters to You.

The Plaid Lie: The Myth of Effortless Safety

The

phrase “Plaid Lie” has become shorthand for an uncomfortable truth: users

assumed the familiar Plaid login meant total safety. It never did.

Even

as the company has strengthened its systems, the overall open-banking network

remains fragmented. Some banks still rely on legacy methods; some apps still

use indirect connections.

The

result is a patchwork of responsibility where consumers often face uncertainty

about who actually safeguards their money.

Until

consistent federal standards return, informed caution is the only defense.

Looking

ahead, several outcomes are likely:

Revised Rulemaking (2026): The

CFPB is expected to release an updated version clarifying fee policies and

liability standards.

Industry Push for Standard APIs: Banks

and fintechs continue to align on Financial-grade API (FAPI) protocols for

encrypted, token-based sharing.

Public Education Efforts: Expect greater emphasis on consumer awareness campaigns around data rights and revocation options.

If

properly implemented, US Open Banking could still deliver financial freedom—but

not until the foundations are rebuilt on security, not convenience.

Q1: What is the status of the CFPB’s

Personal Financial Data Rights Rule?

The rule finalized in 2024 is on hold. A federal court stayed

enforcement in October 2025, and the CFPB is reconsidering several provisions

before re-issuing guidance, expected sometime in 2026.

Q2: Why is

screen scraping considered unsafe?

It relies on sharing your real login

credentials with third parties, allowing broad data extraction beyond what an

app requires. A secure API

eliminates that exposure by using temporary access tokens generated by your

bank.

Q3: Has Plaid

improved its data-handling practices?

Yes. After a 2022 settlement, Plaid

implemented clearer disclosures, expanded its user control portal, and shifted most data traffic to secure APIs.

Still, consumers should manually revoke unused app access.

Q4: Why might

banks charge fees for data access?

Some financial institutions claim

maintaining open-data APIs adds cost. The CFPB is evaluating whether limited

fees are permissible—a proposal that consumer groups argue undermines open

banking’s purpose.

Q5: How can I

see which apps have my data?

Go to my.plaid.com

and sign in using your linked email. You’ll see all authorized apps and can

revoke access instantly.

Q6: What should

I do if a connected app is breached?

Immediately revoke its access in

Plaid or your bank portal, change your bank password, and notify your bank’s

fraud department. Keep documentation of all alerts.

Q7: Are secure

APIs already active in the U.S.?

Yes. Major institutions like

JPMorgan Chase, Wells Fargo, and Bank of America already use token-based

connections with Plaid and other aggregators. The challenge lies in full

adoption across smaller banks.

Q8: Does the

frozen rule affect my daily app use?

Not directly, but it delays uniform

security standards. You may still encounter apps using outdated scraping

technology. Favor apps listing “secure API” or “OAuth” connections.

Q9: Who is

responsible if unauthorized transactions occur through an app?

Currently, liability is shared and

case-specific. One goal of the revised CFPB rule is to establish a clear,

consistent liability chain.

Q10: How can

consumers influence the rule’s outcome?

Public comments shape revisions.

Submitting feedback on the CFPB’s website or supporting consumer advocacy

groups ensures that user-centric data protections stay a priority.

Comments (0)

Leave a Comment

No comments yet

Be the first to share your thoughts!